How to Save Money in Dubai Like a Pro: 14 Smart Money Moves

Dubai is an incredible city that offers a luxurious lifestyle, but it can also be expensive. With rising living costs, knowing how to save money in Dubai is essential for residents and expats alike. Whether you are here long-term or for a short stay, adopting smart financial habits can help you manage expenses and grow your savings. Here are some practical and effective money-saving hacks to make your dirhams stretch further.

- Create a Budget and Stick to It

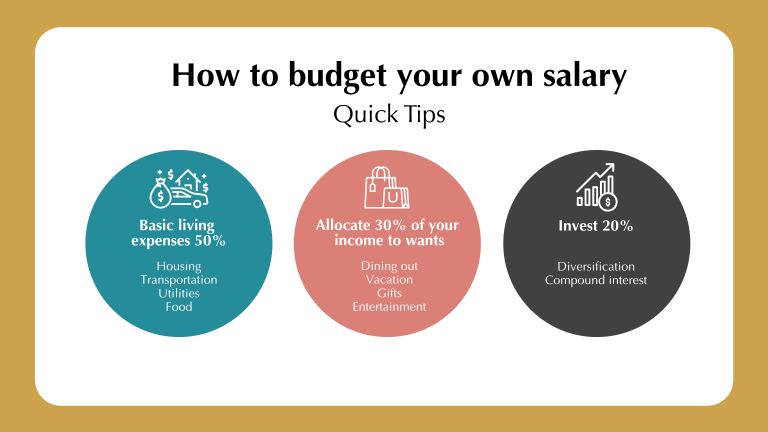

The foundation of smart financial planning begins with a budget. Track your income and expenses using the 50/30/20 rule:

- 50% on essentials (rent, utilities, groceries, transport, and insurance)

- 30% on wants (dining out, shopping, entertainment)

- 20% on savings and investments

Using expense-tracking apps like YNAB or Mint can help you stay within budget and identify areas where you can cut costs.

- Open a High-Interest Savings Account

Your savings should be working for you. Many UAE banks offer savings accounts with competitive interest rates. Research banks for best rates and terms:

Look for accounts with no maintenance fees and competitive interest rates to maximize your returns.

- Shop Smart for Groceries

Groceries are a major monthly expense, but strategic shopping can save you thousands of dirhams annually:

- Buy in bulk from supermarkets like Carrefour, Lulu, or Union Coop

- Use discount apps such as Smiles by Etisalat and The Entertainer

- Compare prices across supermarkets before purchasing

- Avoid impulse buys and stick to a grocery list

- Cut Down on Dining Out

Dubai has an endless selection of restaurants, but eating out frequently can take a toll on your finances. To save:

- Limit dining out to special occasions

- Use food delivery apps like Zomato or Deliveroo to find deals

- Take advantage of buy-one-get-one-free offers with The Entertainer

- Cook at home more often—it’s usually healthier and cheaper!

- Utilize Public Transport or Carpool

While having a car is convenient, transportation costs in Dubai add up. You can save money by:

- Using the Dubai Metro, buses, or trams instead of taxis

- Getting a monthly Nol card for unlimited travel

- Carpooling with colleagues

6. Reduce Utility Bills

Electricity and water bills can be high, especially in the summer. Save on utilities by:

- Setting the AC to 24°C, the optimal energy-saving temperature

- Using LED bulbs to cut down electricity costs

- Turning off lights and unplugging devices when not in use

- Run full loads in your washing machine to save on water consumption

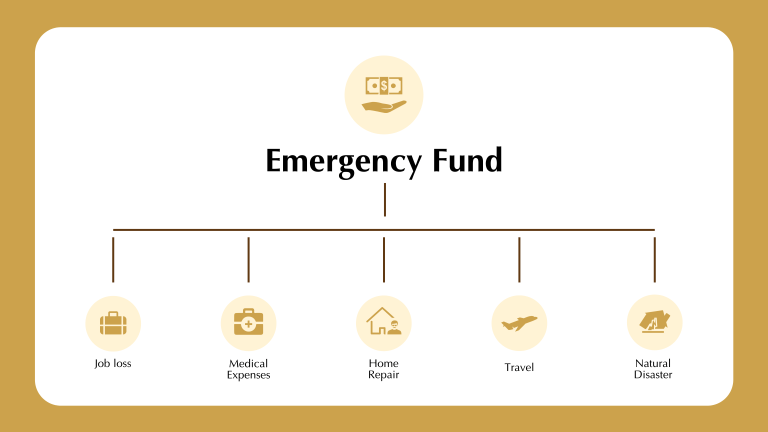

7. Build an Emergency Fund

Having an emergency fund is crucial for financial security. Unexpected expenses such as medical bills, car repairs, or job loss can occur at any time. Aim to save at least three to six months’ worth of living expenses in a separate savings account. Start by setting aside a small portion of your income each month and gradually build your fund to ensure you have a financial cushion in case of emergencies.

- Look for Rental Deals and Negotiate

Rent is one of the biggest expenses in Dubai. You can save on rent by:

- Consider budget-friendly areas

- Negotiating rent with your landlord before renewing your lease

- Opting for annual rent payments instead of monthly instalments (if feasible)

- Consider flat-sharing if living alone is too expensive

- Buy Second-Hand and Use Free Classifieds

Dubai has a thriving second-hand market where you can find great deals on furniture, electronics, and clothing. Websites and apps to check out:

- Dubizzle (for furniture, cars, electronics)

- Facebook Marketplace (for all kinds of goods)

- Take Advantage of Free Activities

Entertainment in Dubai doesn’t always have to cost a fortune. Enjoy free activities such as:

- Strolling along Dubai Marina or JBR Beach

- Exploring Al Seef or Al Fahidi Historical District

- Watching free fountain shows at Dubai Mall

- Hiking in Hatta or Jebel Jais

- Use Credit Cards Wisely

Credit cards in Dubai offer amazing cashback and reward benefits if used correctly:

- Opt for cards with cashback on groceries, fuel, and dining

- Pay off the balance in full each month to avoid interest

- Leverage loyalty programs such as Air Miles, Etihad Guest, or Emirates Skywards

- If you have debt, consider consolidating it

Debt should be actively paid off on a consistent basis to ensure that you are not caught in a continued trap of paying high-interest rates.

This is especially true if you are looking for tricks for how to save money in Dubai.

Credit card interest rates can reach as high as 36% per annum in this region. Balances that are being carried on your credit cards month after month eat into your net-worth and can cause you to enter into a debt trap.

Moreover, reducing debt should take relative priority from other wealth-building activities, such as the emergency fund mentioned above. This doesn’t mean that you should delay building an emergency fund, but rather put a proportionate focus on reducing the debt profile.

Depending on the size of your debt, you could consider various tactics. For example, if you have a large debt profile, clearing those debts through the debt snowballing system should be a priority.

13. Invest for Long-Term Financial Growth

Saving money is essential, but growing your wealth through investments is equally important. Consider:

- Opening an investment account with trusted provider like Nexus

- Setting up an automated savings and investment plan

14. Find Side Hustles to Boost Your Income

Increasing your income can help you save more. Consider:

- Freelancing* (writing, graphic design, consulting)

- Tutoring* (online teaching or language tutoring)

- Selling on platforms like Amazon UAE or Noon*

Saving money in Dubai is all about making informed choices and adopting smart financial habits. Whether it’s budgeting, reducing expenses, or investing, every small step counts toward financial security. By implementing these tips, you can enjoy the vibrant Dubai lifestyle while securing a financially stable future.

Start today—your future self will thank you!