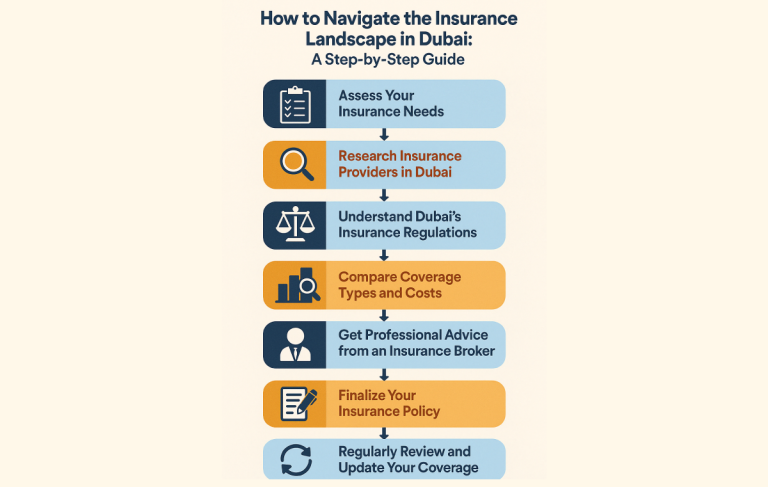

How to Navigate the Insurance Landscape in Dubai:

A Step-by-Step Guide for Expats and Residents

Dubai, the city of endless opportunities, is not just a global business hub but also home to a vibrant and diverse population of expats and residents. With this growing community comes a unique set of insurance needs, ranging from health and life coverage to auto and property insurance. Understanding how to navigate the insurance landscape in Dubai is crucial for securing the right coverage, staying compliant with local regulations, and ensuring peace of mind.

At Nexus Insurance Brokers LLC, we help you make informed decisions about your insurance needs, whether you’re new to Dubai or a long-term resident. This comprehensive, step-by-step guide will walk you through the process of finding the best insurance options, while highlighting key considerations like local regulations and coverage types.

1. Assess Your Insurance Needs

Before choosing any insurance policy in Dubai, it’s essential to assess your personal or family’s needs. Here are the primary types of insurance coverage you might require:

- Health Insurance: Health insurance is mandatory in Dubai, and employers typically provide coverage for their employees. However, if you are self-employed, you will need to purchase your own health insurance.

- Life Insurance: While life insurance is not mandatory in Dubai, it’s highly recommended for expats with families or dependents.

- Motor Insurance: If you plan to drive in Dubai, vehicle insurance is legally required, with a minimum of third-party liability coverage.

- Home and Property Insurance: For homeowners or renters, property insurance protects against damage, theft, or unforeseen events.

- Travel Insurance: Frequent travelers should consider travel insurance for medical coverage, cancellations, and trip-related losses.

- Research Insurance Providers in Dubai

Dubai’s insurance market is extensive, with both local and international providers offering a wide range of policies. Some of the leading insurance companies in Dubai include:

- Zurich

- AXA Insurance

- Oman Insurance Company

- MetLife

- ADNIC

- LIWA and more

Take time to research these providers, compare their offerings, and read customer reviews to ensure they align with your specific needs and expectations.

3. Understand Dubai’s Insurance Regulations

The UAE government has implemented specific insurance regulations that expats and residents need to adhere to. Here are the key regulations that affect the insurance landscape in Dubai:

- Mandatory Health Insurance: All residents must have health insurance, with employers typically covering employees. If you’re self-employed or a freelancer, you must secure health insurance independently.

- Mandatory Vehicle Insurance: All vehicles in Dubai must be insured with at least third-party liability insurance.

- Life Insurance: While not compulsory, life insurance is highly recommended, especially for expats who have families back home or in need of long-term financial planning.

- Claims Process: It’s essential to understand how the claims process works with each insurer, as it can vary from one company to another.

4. Compare Coverage Types and Costs

When choosing an insurance policy in Dubai, it’s important to compare various factors that affect both the cost and coverage of the plan. Here’s what you should consider:

- Premiums: Premiums vary depending on coverage, personal circumstances, and the insurer. It’s advisable to compare multiple quotes to ensure you’re getting the best value.

- Coverage Limits: Be sure to check the coverage limits of each policy to ensure they align with your needs.

- Exclusions: Understand any exclusions that may affect your claims, such as pre-existing conditions in health insurance or natural disasters in property insurance.

- Customer Service and Claims Process: A company with efficient customer service and a hassle-free claims process is essential. Always review the insurer’s reputation for handling claims promptly.

5. Get Professional Advice from an Insurance Broker

Navigating Dubai’s insurance market can be tricky, especially if you’re unfamiliar with local regulations or coverage options. That’s where an insurance broker like Nexus Insurance Brokers LLC can help. We specialize in assisting expats and residents with the selection of insurance policies tailored to their unique needs.

An experienced insurance broker can provide personalized advice, help you compare multiple insurance policies, and ensure you’re fully compliant with local regulations.

6. Finalize Your Insurance Policy

Once you’ve selected your ideal insurance coverage, make sure to carefully review all the policy terms and conditions. Pay attention to:

- Personal Details: Ensure all your personal information (names, addresses, birthdates) is accurate.

- Policy Terms: Understand the scope of coverage, exclusions, and any additional benefits.

- Documentation: Keep copies of your insurance documents and policy for future reference.

7. Regularly Review and Update Your Coverage

Your insurance needs may change over time, whether due to a change in employment, family circumstances, or health. Make it a habit to regularly review your insurance policies to ensure they continue to meet your needs. At Nexus Insurance Brokers LLC, we offer ongoing support to help you stay on top of your coverage and make updates as needed.

Conclusion

Navigating the insurance landscape in Dubai doesn’t have to be complicated. With the right knowledge, research, and guidance, you can secure the coverage that meets your needs and complies with local regulations. Whether you’re seeking health, life, auto, or property insurance, Nexus Insurance Brokers LLC is here to help you every step of the way.

Key Takeaways:

- Health insurance is mandatory for residents and expats in Dubai.

- Compare insurance premiums, coverage, and exclusions to find the best deal.

- Use an insurance broker to help you navigate Dubai’s insurance landscape.

- Regularly review your policies to keep them updated as your needs evolve.

At Nexus Insurance Brokers LLC, we pride ourselves on delivering personalized insurance solutions that offer you the peace of mind you deserve. Get in touch with us today for expert advice and assistance in choosing the right insurance for your needs.