- LIFE

At Nexus, we understand the importance of ensuring that plans are put in place, to provide complete protection to families when they are most vulnerable.

- SAVINGS

A sound financial plan can provide you with the freedom of choice, to achieve your personal dreams and aspirations.

- CAR

- HEALTH

- HOME

- TRAVEL

- CONTACT US

- Blogs

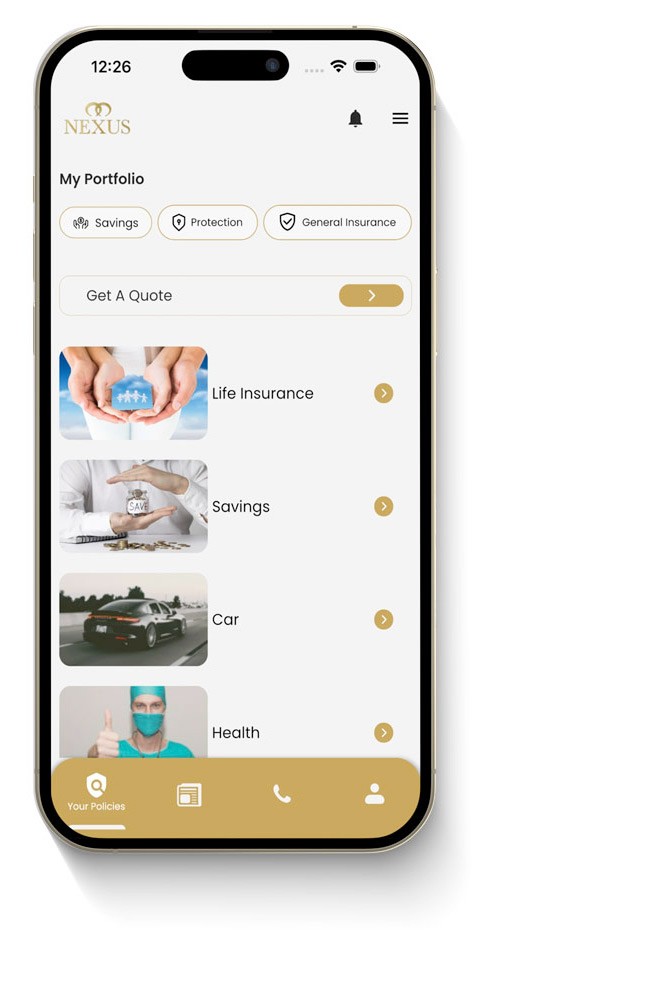

- Client App

- CLIENT LOGIN